Brief Overview of Tyre Sector

The tyre industry is pivotal in the automotive sector, driven by OEM and replacement segments. Current OEM demand aligns with new automobile production trends, while the replacement segment is linked to usage patterns. Presently, the replacement sector holds a significant market share, with a notable 133% surge in radial tyre adoption for passenger cars from April to August 2021. In contrast, only 60% of truck and bus tyres and 40% of LCV tyres have transitioned to radials.

In the fiscal year 2019, the Indian tyre industry exceeded £7.41 billion, involving over 40 manufacturers in 60 production facilities. Employing over 2 million people directly and supporting over 1 million jobs indirectly, the industry is substantial.

The top 10 players collectively dominate 90-95% of the market share, with the leading few in each segment controlling 70-80%. Major players like MRF, Apollo Tyres, and JK Tyres collectively capture around 60%. Despite intense segment-level competition, no single manufacturer holds dominant market share or significant pricing power, resulting in a moderately competitive industry overall (Source: Present Scenario of Tyre Industry in India, The Role and Relevance in Indian Economy).

Manufacturing Process and Energy Consumption

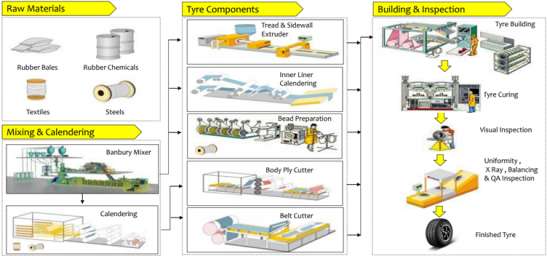

Manufacturing tyres involves the conversion of raw materials into final products utilised in diverse vehicles. The tyre industry, characterised by specialisation, relies on advanced technology and machinery to produce resilient and top-quality tyres. Key raw materials in tyre manufacturing encompass natural and synthetic rubber, carbon black, and various chemicals. These materials undergo meticulous blending and processing to form distinct tyre components, such as treads, sidewalls, and inner liners. The tyre production process encompasses crucial stages like mixing and extrusion, calendaring, building, curing, and inspection and testing, all subject to rigorous quality control to ensure adherence to specifications and performance standards.

In the initial step of mixing and extrusion, raw materials are blended in a sizable mixer and then heated and extruded through a machine, forming tyre components like treads, sidewalls, and inner liners. Following this, calendaring involves passing the extruded rubber through rollers to achieve uniform thickness and shape, with the rubber subsequently cut and marked as needed. The subsequent building stage involves the assembly of tyre components into a cohesive unit, including placing the inner liner, adding the tread and sidewall, and moulding the tyre into its final shape.

Fig: Tyre Manufacturing Process (Source: Presentation of JK Tyre, Chennai)

The total energy consumption at manufacturing sites showed a notable increase of 11% from 2009 to 2010. Following this, it remained relatively steady until 2018. In 2019, the overall energy consumption remained constant when compared to 2018 levels. However, in 2020, amid the COVID-19 pandemic, there was a significant decline in total energy consumption by ~12%, aligning with the production levels. During the period from 2019 to 2020, there was a 5% increase in energy intensity. This heightened intensity can be attributed to a comparatively smaller decrease in energy consumption compared to the reduction in production. Some production lines continued operations despite reduced activity, and certain machinery, such as heating equipment, remained in continuous operation (Source: Environmental Key Performance Indicators for Tire Manufacturing 2009-2020, Tire Industry Project 2021, World Business Council for Sustainable Development).

PAT Scheme for Tyre Sector

As per notification from Ministry of Power dated 6th June 2023, Units of tyre manufacturer plants or establishments those are under manufacturing of tyres, having energy consumption of 7,000 metric tonne of oil equivalent per year and above will qualify as a Designated Consumer in Tyre Manufacturing Sector. This sector is yet to be covered in the PAT scheme.

Best Practices Adopted by Tyre Sector

Tyre industries have adopted the following key operational best practices and technologies as part of their Industrial Energy Efficiency and Decarbonisation (IEED) measures:

· Recycling and Waste Management.

· Installation of (Variable Frequency Drive) VFDs.

· Use of energy though Renewable Resources.

· Replacing air blower fans to energy efficient fans.

· Use of energy efficient (IE-3) motor in place of conventional motor.

Details of Line Ministries

· Ministry of Commerce and Industry

Details of Specialised Organization / Research Institute

· Indian Tyre Technical Advisory Committee (ITTAC)

Details of Industrial Associations

· Automotive Tyre Manufacturers' Association (ATMA)

List of Key Technologies

· Use of Eco tyres (made up of compounds of different types of rubber and other materials that work together to decrease friction with the road to increase fuel efficiency).

· Thermal Energy Management System (TEMS) technology. This can help to improve the efficiency of rubber manufacturing processes by reducing the amount of energy needed to heat and cool the process. This can lead to significant savings on energy costs.

· Energy efficiency solutions and equipment upgrades.

· Use of Carbon Nanotubes (CNT) in Tyres.

List of EE and Decarbonisation Technology Providers (National& International)